Business Insurance in and around Franklin

One of Franklin’s top choices for small business insurance.

This small business insurance is not risky

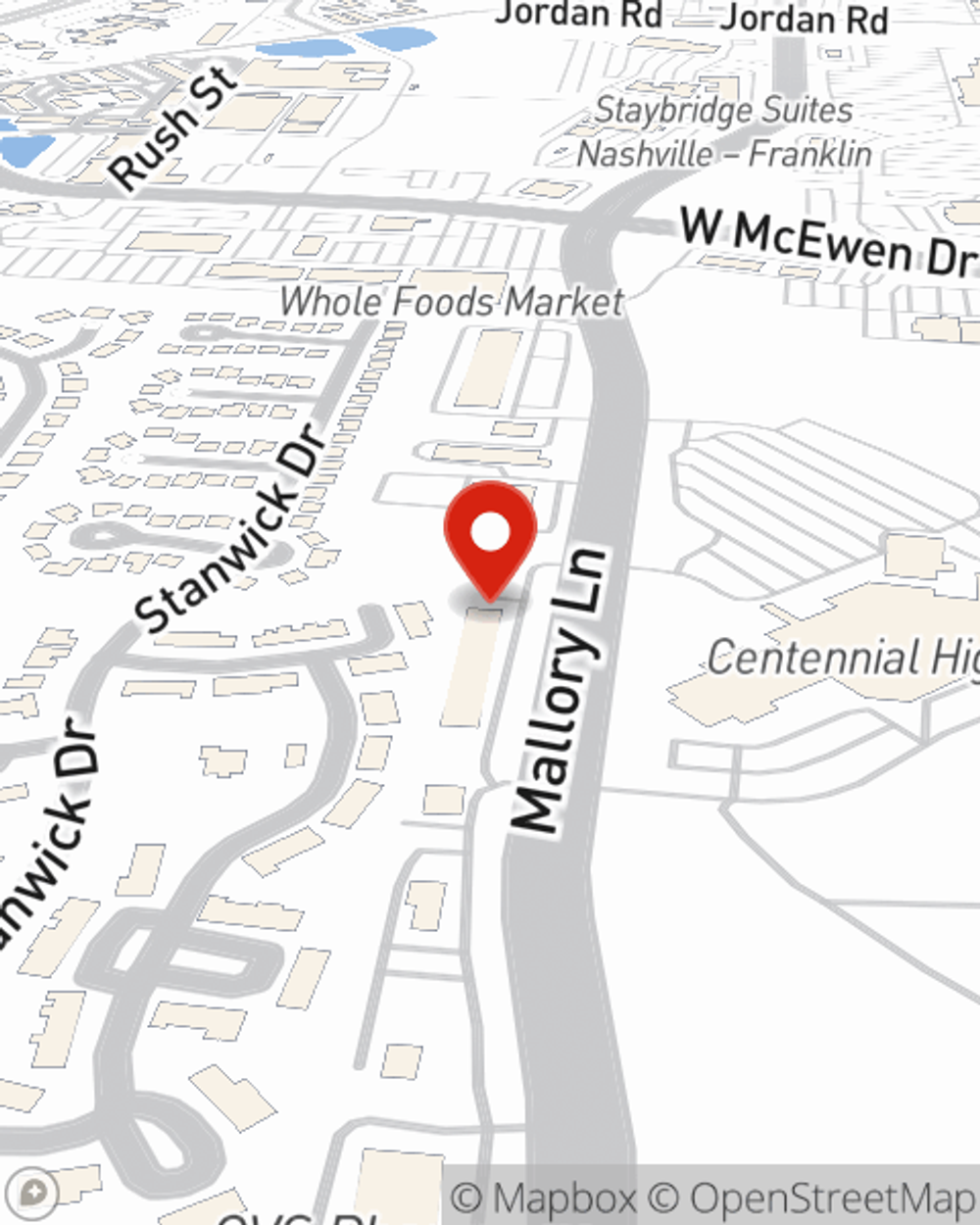

- Franklin. TN

- Brentwood, TN

- College Grove

- Spring Hill

- Nashville, TN

- Thompson's Station

- Fairview

- Columbia

Your Search For Great Small Business Insurance Ends Now.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a customer stumbling and falling on your business's property.

One of Franklin’s top choices for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

With options like a surety or fidelity bond, business continuity plans, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Caroline Pistole is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Take the next step of preparation and get in touch with State Farm agent Caroline Pistole's team. They're happy to help you discover the options that may be right for you and your small business!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Caroline Pistole

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.